FOMC December 2025 Rate Cut Analysis: Impact on Bitcoin Price and Crypto Market for WEEX Users

The Federal Open Market Committee (FOMC) meeting on December 10, 2025 concluded with a widely anticipated 25 basis points (0.25%) rate cut, bringing the federal funds target range to 3.50%–3.75%. This marks the third consecutive rate cut in 2025, signaling the Fed’s ongoing effort to balance inflation control with supporting economic growth. Leading up to the announcement, Bitcoin prices had been hovering near $90,000, and following the rate cut, BTC briefly spiked above $94,000 before stabilizing around its current level of ~$90,000. This price movement reflects a moderate market reaction, as traders had largely priced in the expected rate cut.

Understanding the FOMC: Why Crypto Traders Should Care About Federal Reserve Decisions

The FOMC, or Federal Open Market Committee, is the policy-making branch of the U.S. Federal Reserve, responsible for setting the direction of U.S. monetary policy, including interest rates and liquidity operations. The committee meets eight times per year to assess economic conditions and determine whether monetary policy should be tightened or loosened. Decisions by the FOMC directly affect traditional financial markets such as equities, bonds, and currencies, and indirectly influence crypto markets, including Bitcoin and altcoins, because interest rate changes affect liquidity, risk appetite, and global capital flows. For WEEX users, staying informed about FOMC actions is crucial, as these events can drive short-term volatility and shape longer-term crypto market trends.

The December 2025 FOMC Rate Cut: Background and Detailed Analysis

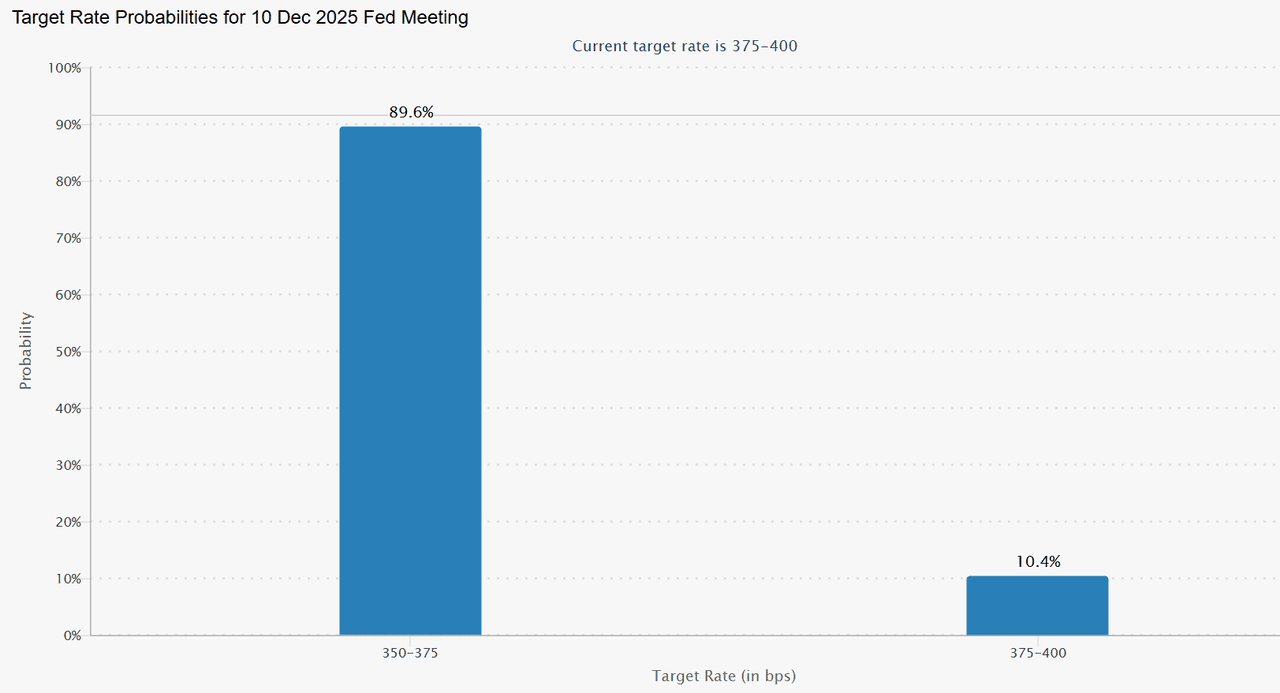

The Federal Reserve’s December 2025 FOMC meeting delivered the anticipated 25-basis-point rate cut, lowering the federal funds target range to 3.50%–3.75%. Because CME FedWatch had already priced in nearly a 90% probability of this move, markets—especially crypto—showed limited reaction. BTC briefly spiked above $94,000 before stabilizing around its current level of ~$90,000. The macro backdrop also explains the Fed’s caution: job growth has slowed, the unemployment rate has risen to 4.4%, and inflation remains above target but is driven mainly by one-off tariff effects rather than broad price pressures. Powell noted that consumer spending and business investment remain resilient, yet the labor market is clearly losing momentum, raising downside risks. These mixed signals shaped a tone of policy restraint rather than confidence.

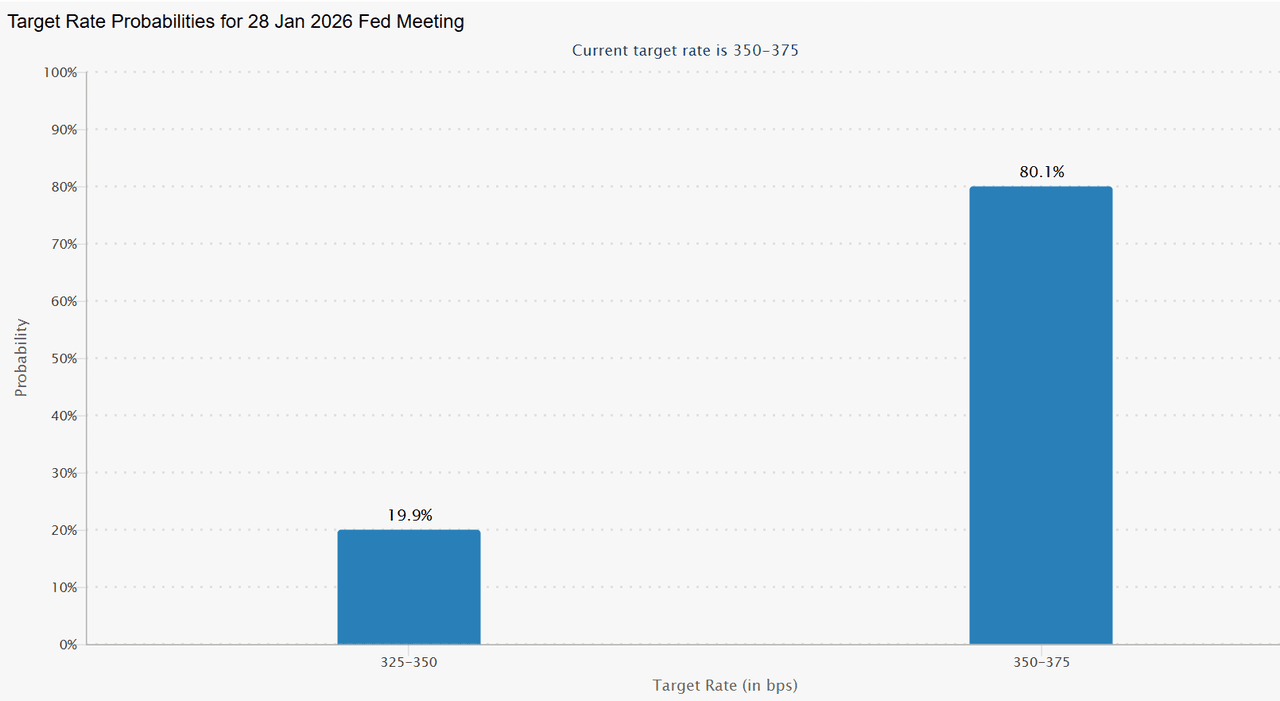

Equally important, the Fed signaled it is not committing to a rate-cut cycle. At the time of writing, FedWatch priced just a 19.9% chance of another 25bps cut at the next FOMC, versus an 80.1% likelihood of holding rates steady—an abrupt shift from the near-certainty of easing before this meeting. On liquidity, the Fed announced $40B in T-bill purchases for the first month and continued repo/RRP tools to maintain ample reserves, but Powell stressed these are technical operations, not QE. With no surprise, no strong forward guidance, and no meaningful liquidity injection, the meeting delivered little for risk assets to latch onto. For Bitcoin and broader crypto, this data-dependent, one-and-wait stance explains why price action remained muted despite the headline rate cut.

Impact of the FOMC Rate Cut on Bitcoin and the Crypto Market

Crypto markets historically rally when the Fed delivers unexpected dovish surprises, and this meeting contained none. Even the Fed’s liquidity measures—including $40B in T-bill purchases and expanded repo operations—were understood as routine reserve management rather than true stimulus, meaning no significant liquidity wave is expected to lift BTC or altcoins in the near term. Overall, while the December decision improves the macro setting compared to earlier in the year, the absence of new dovish catalysts explains why Bitcoin did not deliver a significant post-FOMC rally.

WEEX User Takeaways: How to Navigate Crypto Markets Post-FOMC

For WEEX users, the December FOMC rate cut offers several actionable insights for navigating the current market environment. With volatility often spiking around major policy events, traders should maintain realistic expectations—especially when outcomes are fully priced in, as seen with Bitcoin’s muted reaction. For those seeking a more steady approach amid uncertainty, WEEX Auto Earn provides a flexible, hands-free way to grow USDT holdings. Once activated, it automatically captures daily balance snapshots, applies tiered interest rates with no lock-up, and deposits earnings the next day. New users who complete KYC verification can also access exclusive introductory APR rates up to 100% within designated limits — offering both stability and enhanced yield potential as markets digest the post-FOMC landscape.

About WEEX

Founded in 2018, WEEX has developed into a global crypto exchange with over 6.2 million users across more than 150 countries. The platform emphasizes security, liquidity, and usability, providing over 1,200+ spot trading pairs and offering up to 400x leverage in crypto futures trading. In addition to traditional spot and derivatives markets, WEEX is expanding rapidly in the AI era — delivering real-time AI news, empowering users with AI trading tools, and exploring innovative trade-to-earn models that make intelligent trading more accessible to everyone. Its 1,000 BTC Protection Fund further strengthens asset safety and transparency, while features such as copy trading and advanced trading tools allow users to follow professional traders and experience a more efficient, intelligent trading journey.

Follow WEEX on social media

Telegram: WeexGlobal Group

YouTube: @WEEX_Global

TikTok: @weex_global

Instagram: @WEEX Exchange

Discord: WEEX Community

You may also like

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

XRP Price Prediction: Could XRP Ultimately Surpass Bitcoin and Ethereum?

Key Takeaways XRP has maintained a strong position despite a recent 12% drop, suggesting potential for growth. Analyst…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market is experiencing pressure due to a technology-sector selloff, affecting digital assets like Bitcoin.…

South Korea Broadens Crypto Market Investigation Following Bithumb’s $44 Billion Bitcoin Error

Key Takeaways South Korea intensifies scrutiny on cryptocurrency exchange operations after Bithumb’s significant Bitcoin transaction error. Regulatory bodies,…

Tom Lee-Supported Bitmine Dominates 3.6% of Ethereum Supply Post-Price Crash

Key Takeaways Bitmine Immersion Technologies now controls 3.6% of Ethereum’s total supply after strategic purchases during market downturns.…

XRP Yearly Returns Hit Record Low Since 2023

Key Takeaways XRP’s yearly returns are at their lowest since 2023, as the crypto market grapples with a…

BTC Traders Eye $50K as Potential Bottom: Key Metrics to Monitor This Week

Key Takeaways Traders are closely monitoring the potential bottom for Bitcoin at $50,000 as recent price movements suggest…

Fraudulent ‘XRP’ Issued Token Sparks Confusion on the XRP Ledger

Key Takeaways An imposter XRP token is causing bewilderment within the XRP community by being superficially identical to…

XRP Yearly Returns Reach Their Lowest Point Since 2023

Key Takeaways XRP’s weakest annual performance since 2023 highlights the ongoing struggles within the cryptocurrency market. Market dynamics…

Cardano ‘Midnight Fixes Everything’: Charles Hoskinson

Key Takeaways Cardano’s Midnight sidechain, launched in December 2025, is championed by Charles Hoskinson as a solution to…

SHIB Army Burns 3,564,772 SHIB, While Half Quadrillion Coins Remain in Circulation

Key Takeaways The Shiba Inu community has collectively burned nearly 3.5 million SHIB tokens recently, yet a substantial…

XRP Ledger Network Activity Decreases by 80% as Institutional Participation Wanes

Key Takeaways: Recent metrics indicate an 80% decline in XRP Ledger network activity, correlating with diminished institutional involvement.…

Michael Saylor Insists “We Will Not Be Selling” As Strategy (MSTR) Stock Breaks Out

Key Takeaways Strategy, formerly MicroStrategy, remains highly sensitive to Bitcoin’s volatile market, with its stock performance closely mirroring…

Brad Garlinghouse Adds Personal Touch to XRP Community Day with Exclusive Merch

Key Takeaways Brad Garlinghouse, CEO of Ripple, has personally signed exclusive merchandise for XRP Community Day, adding excitement…

PIPPIN Price Surge Signals Potential Breakout Despite Investor Selling

Key Takeaways PIPPIN has experienced a significant rally, with its price increasing by 159%, nearing its all-time high.…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

XRP Price Prediction: Could XRP Ultimately Surpass Bitcoin and Ethereum?

Key Takeaways XRP has maintained a strong position despite a recent 12% drop, suggesting potential for growth. Analyst…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market is experiencing pressure due to a technology-sector selloff, affecting digital assets like Bitcoin.…