BTC Reaches $87,000 Again, Is the Bull Market Back?

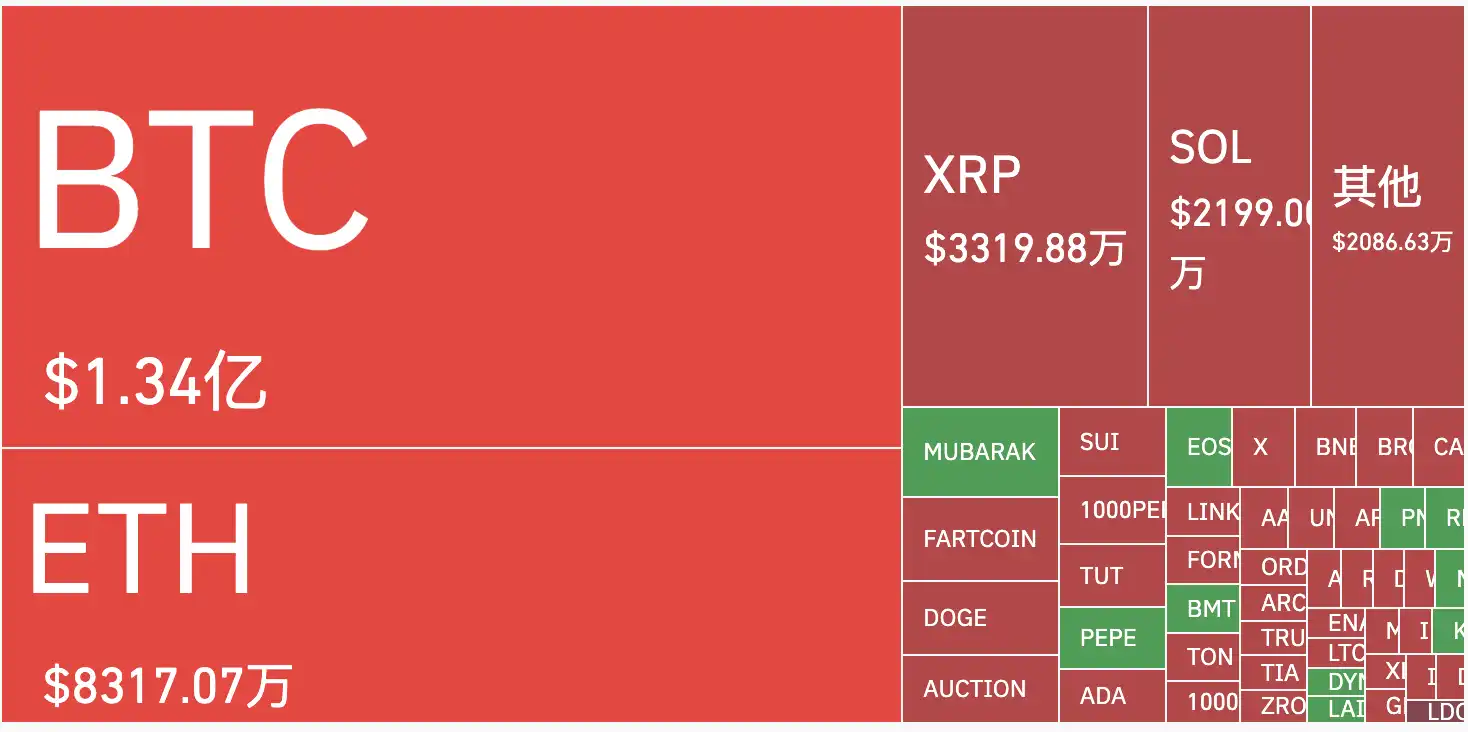

BTC rose from a low of $81,500 last night and continued to climb after the early morning Federal Reserve interest rate decision meeting, retesting $87,000 this morning. The sense of panic seems to have slowly subsided, and the market's lowest point is gradually passing. In the past 24 hours, a total of 101,662 people worldwide have been liquidated, with a total liquidation amount of $353 million, primarily in short positions. BlockBeats collected some community members' views on the market's uptrend and summarized three reasons for the rise.

Fed Turns Dovish: Liquidity Floodgates Open

The monetary policy of the Federal Reserve plays a crucial role in the crypto market. On March 20, the Fed decided to keep the interest rate unchanged at 4.25-4.50% and sent a dovish signal, hinting at a possible rate cut later this year due to slowing inflation data and growing economic growth concerns, in line with market expectations. It also announced a significant slowdown in the pace of balance sheet reduction (QT) to ease market liquidity pressures. Fed Chair Powell reassured investors that the risk of a recession is low, the U.S. economy remains strong, and the labor market remains solid.

The dovish Fed has reduced the opportunity cost of holding non-yielding assets, driving funds from low-yield bonds to risk assets. Today's uptrend may reflect institutional investors and ETF providers reallocating funds to Bitcoin, anticipating looser monetary conditions. With liquidity flowing into the market, the Bitcoin price broke through resistance levels, triggering investors' FOMO mentality.

In fact, institutional bullish sentiment seems to have returned. Despite a 11.4% drop in Bitcoin over the past 30 days, BlackRock remains confident in BTC. The world's largest asset management company recently increased its holdings in the iShares Bitcoin Trust IBIT by 2,660 bitcoins, the largest inflow into the fund in the past six weeks. After a period of uncertainty in fund flows since early February, this significant purchase indicates that institutions are once again positioning themselves for a potential rally as market conditions evolve.

Market analyst "IncomeSharks" believes Bitcoin is rebounding at a super-trend support level and still maintains a buy signal. Looking back at BTC's performance at the OBV (On-Balance Volume) resistance level and diagonal resistance level, the follow-through at the arrow point is a clear bullish signal of strength.

Note: OBV is a technical analysis indicator that predicts price changes in stocks or cryptocurrencies by using volume flow. OBV increases volume on days when the price rises and decreases volume on days when the price falls, forming an accumulation line that reflects buying and selling pressure. As institutional activity increases and market volatility intensifies, investors will pay more attention to volume-based indicators.

Arthur Hayes also posted on social media, stating that Powell has indicated that Quantitative Tightening "QT" is basically ending on April 1st. The market now needs a truly bullish signal, either a Supplementary Leverage Ratio "SLR" exemption or a Quantitative Easing "QE" restart. A $77,000 Bitcoin price is highly likely the bottom.

RSI Oversold, Decline in Panic Sentiment

As of March 2025, Bitcoin's futures funding rate has remained negative for several months in a row, indicating a strong bearish sentiment among leveraged traders, but this has also created a potential springboard for an uptrend. A negative funding rate means that short holders are paying fees to longs, which usually occurs during price declines or oversold conditions.

With the recent decline in panic sentiment, driven by stable gold prices, reduced trade war concerns, and Trump's crypto-friendly signals, Bitcoin is emerging from panic-driven consolidation. Historical data shows that a negative funding rate often precedes price rallies. Today's uptrend may be the result of bulls accumulating at these "discount" prices, with panic subsiding and optimism returning, pushing the price higher.

Trader "MerlijnTrader" believes that a Bitcoin rebound is imminent, pointing out that the RSI indicator is in oversold territory, and Bitcoin has just hit a key bottom signal. Historically, whenever this signal has appeared, BTC has experienced a strong rebound.

Global M2 Continues to Rise: Inflation Hedge Attractiveness Strengthened

In early 2025, global M2 has steadily risen due to coordinated loose policies by the Federal Reserve, European Central Bank, and others. This expansion, driven by low-interest rates and bond purchases, reflects the environment where Bitcoin emerges as a hedge against fiat devaluation.

With increasing global liquidity, Bitcoin's limited supply becomes more attractive as a store of value, especially amid concerns over the US dollar hegemony and Trump's tariff policies. Bitcoin theoretically can offset the erosion of asset value due to inflation. Today's uptrend might reflect institutions and retail investors pouring into BTC as a hedge tool against the rising M2, driving the price towards new highs.

Analyst Crypto Raven "hiRavenCrypto" believes that the comparison between M2 and BTC prices is usually proportionally related. But recently, a gap has emerged, indicating that the BTC price has yet to catch up with M2. This suggests an imminent surge in $BTC price, potentially reaching at least 100K.

Although uncertainty lingers, with the Fed signaling dovishness, the current market has shown clear signs of a bottom: institutional re-entry, oversold RSI, negative funding rates, and a bounce off technical support levels. Large institutions like BlackRock have been actively increasing their holdings, and more government entities, such as "Arizona passing two BTC reserve bills yesterday," are starting to consider Bitcoin reserves, restoring market confidence.

You may also like

February 10th Key Market Information Gap, A Must-See! | Alpha Morning Report

About ERC-8004: Everything You Need to Know

ai.com's Debut Flop: After $70 Million Transaction, Did It Get a '504' Timeout?

FedNow versus The Clearing House: Who Will Win the Fed Payments Fray?

Recovering $70,000 in Lost Funds: The "Fragile Logic" Behind Bitcoin's Rebound

Mr. Beast acquires Step, Farcaster Founder Joins Tempo, what are the international crypto circles talking about today?

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Earn

Earn