Bloomberg: $1.3 Billion Accounting Loss, Is Tom Lee's Ethereum Bet Facing Collapse?

Original Title: Tom Lee's Big Crypto Bet Buckles Under Mounting Market Strain

Original Author: Sidhartha Shukla, Bloomberg

Original Translation: Chopper, Foresight News

The Ethereum corporate treasury experiment is currently on the verge of collapse.

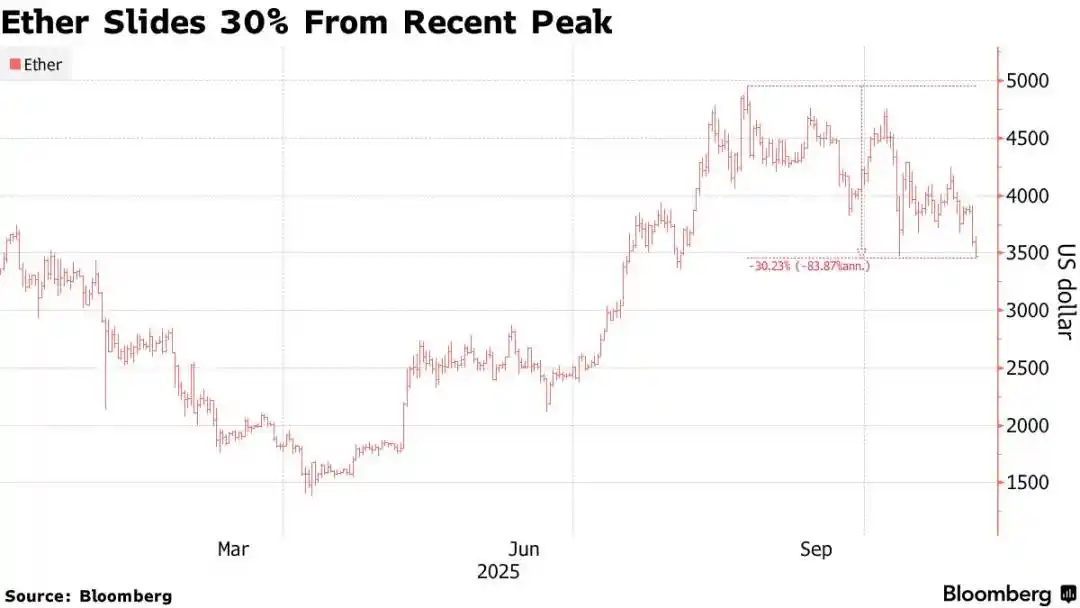

The world's second-largest cryptocurrency dropped below $3,300 on Tuesday, in sync with the market's benchmarks such as Bitcoin and tech stocks. This decline has pushed Ethereum's price down by 30% from its August peak, falling to levels before the large-scale corporate buy-in, further solidifying its bearish trend.

According to research firm 10x Research, this reversal has put Ethereum's most fervent corporate supporter, Bitmine Immersion Technologies Inc., at a staggering $1.3 billion paper loss. This publicly traded company, backed by billionaire Peter Thiel and led by Wall Street analyst Tom Lee, whose strategy mimicked Michael Saylor's Bitcoin treasury model, purchased 3.4 million Ethereum at an average price of $3,909. Today, Bitmine's treasury is fully deployed and facing increasing pressure.

10x stated in its report, "For months, Bitmine has been driving the market narrative and fund flows. Now with its treasury fully deployed, facing a paper loss of over $1.3 billion, and no available additional funds."

The report notes that retail investors who bought Bitmine stock at a premium to net asset value (NAV) have suffered even greater losses, and the market's willingness to catch falling knives is limited.

Lee did not immediately respond to a request for comment, and representatives from Bitmine did not respond immediately either.

Bitmine's bet is far from a simple asset-liability trade. Behind the company's accumulation is a grander vision: the transition of digital assets from speculative tools to corporate financial infrastructure, thereby cementing Ethereum's position in the mainstream financial realm. Supporters believe that by integrating Ethereum into a publicly traded company's asset treasury, enterprises will help build an entirely new decentralized economy. In this economic system, code replaces contracts, and tokens serve as assets.

This logic drove the summer bull run. Ethereum's price once approached $5000, and only in July and August, Ethereum ETFs attracted over $90 billion in inflows. However, after the crypto market crash on October 10, the situation reversed: according to Coinglass and Bloomberg compiled data, Ethereum ETFs saw outflows of $8.5 billion, and Ethereum futures' open interest decreased by $16 billion.

Lee had previously predicted that Ethereum would reach $16,000 by the end of this year.

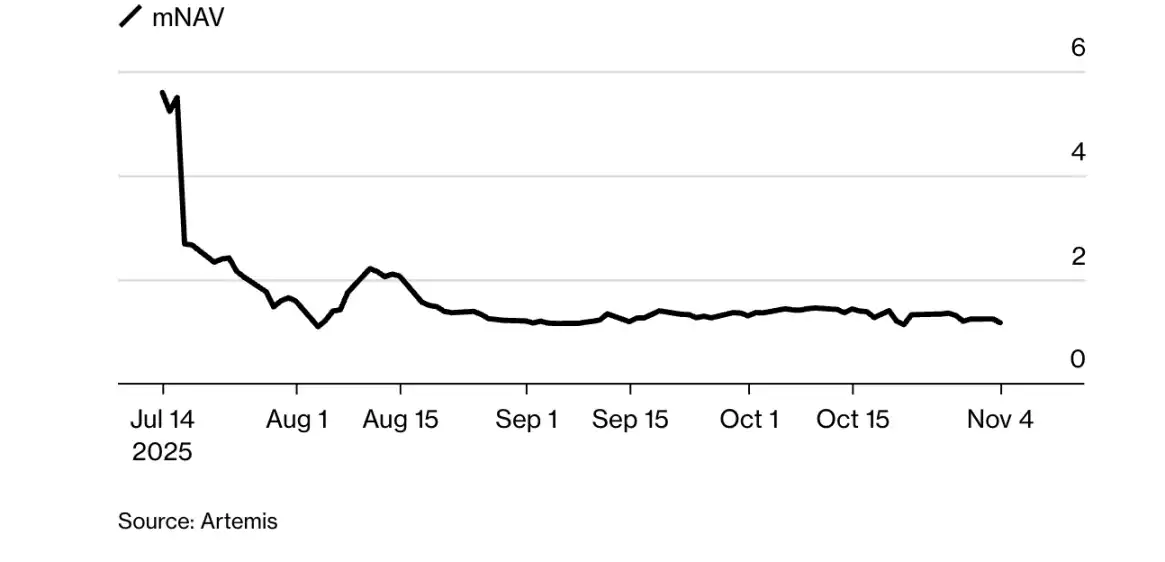

Bitmine's Net Asset Value (mNAV) Premium Decline

According to Artemis data, Bitmine's market cap to net asset value multiple has plummeted from 5.6 in July to 1.2, with its stock price falling 70% from its peak. Similar to other Bitcoin-related companies before it, Bitmine's stock price is now closer to its underlying asset value, as the market reevaluates the once high valuation of its crypto asset balance sheet.

Last week, another publicly traded Ethereum treasury company, ETHZilla, sold $40 million worth of Ethereum holdings to buy back shares, aiming to bring its modified Net Asset Value (mNAV) ratio back to a normal level. The company stated in a press release at that time: "ETHZilla plans to use the proceeds from the remaining Ethereum sales for further share buybacks and intends to continue selling Ethereum to repurchase shares until the discount to Net Asset Value normalizes."

Despite the price decline, Ethereum's long-term fundamentals appear to remain strong: its on-chain value processed still exceeds that of all competing smart contract networks, and the staking mechanism gives the token both yield attributes and deflationary properties. However, as competitors like Solana gain momentum, ETF flows reverse, and retail interest wanes, the narrative of "institutional stability in cryptocurrency prices" is gradually losing relevance.

You may also like

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Leading AI Claude Predicts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways Claude AI projects substantial growth for XRP, Cardano, and Ethereum by the end of 2026, with…

Crypto Price Forecast for 16 February – XRP, Ethereum, Cardano

Key Takeaways Technical trends and recent developments suggest potential growth for XRP, Ethereum, and Cardano. XRP is targeting…

Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

Key Takeaways Recent market movements have sparked concerns over a potential bear market for Bitcoin, marked by significant…

XRP Price Forecast: Can XRP Truly Surpass Bitcoin and Ethereum? Analyst Argues the Contest Has Already Begun

Key Takeaways XRP has maintained significant support around the $1.40 level despite a 12% decline over the past…

Best Crypto to Purchase Now February 6 – XRP, Solana, Bitcoin

Key Takeaways XRP’s Strength: Ripple’s focus on challenging traditional systems like SWIFT is driving XRP towards a potential…

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…